Find relevant news for you

How BNP Paribas CIB’s employee networks are driving progress on gender equity

The Bank’s gender-focused networks are driving progress on representation and inclusion through recruitment, retention and client engagement initiatives.

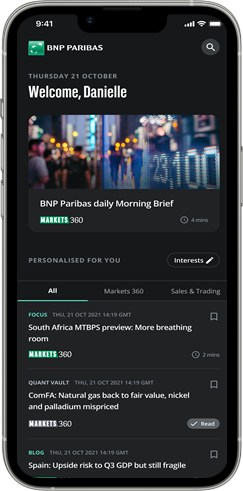

BNP Paribas Global Markets App

The app for a changing world

Broaden your perspectives by tapping into BNP Paribas’ views, analysis and daily insights from the Markets 360TM Strategy and Economics team and Sales & Trading desks – anytime, anywhere – and in a fully customised way!

Listen to Markets 360

Global Markets podcast

Luigi Speranza, Global Head of Markets 360 and his team give you an overview of the latest market insights in short episodes.

BNP Paribas’ Social Bond Framework

Paving the way in sustainable solutions

Introducing the BNP Paribas Social Bond framework, created to help investors participating in initiatives that support greater social benefits. This inclusive framework is in line with the social bond principles as outlined by the ICMA.

Awards

Outstanding 12 accolades for BNP Paribas at the Italian Certificate Awards 2023

BNP Paribas wins gold for Best Issuer of the Year, Best Private: BNL BNP Paribas Private Banking and Life Banker and Best Knock-Out Leverage Certificates in Italian Certificate Awards 2023.

IFR recognises BNP Paribas for global innovation

The Bank was awarded eight prestigious accolades across ESG financing, Bonds, Loans, Equities, and Derivatives.

02 February 2024

EMEA Corporate FX Quality Leader Awards

BNP Paribas has won a number of categories at the 2024 Greenwich Leaders Awards

Risk recognises BNP Paribas at its prestigious annual awards

BNP Paribas receives two accolades at the Risk Awards 2024 for its inflation derivatives and credit portfolio businesses.

BNP Paribas wins Base Metals House of the Year for 6 consecutive years

BNP Paribas was awarded Base Metals House of the Year at the Energy Risk Awards for the 6th consecutive year.

BNP Paribas wins Americas Credit Derivatives House of the Year

BNP Paribas has won recognition as Americas Credit Derivatives House of the Year at GlobalCapital’s 2022 Americas Derivatives awards.